Your Own Home? Easy on Up.

Up Home is designed to guide you along your entire journey to home ownership and beyond. From saving, to buying and applying, we’ve reimagined every step to be simple and not drain your brain – something you can do from the comfort of your couch (no economics degree required).

DIY with no downside

Up Home makes buying a home something you can handle yourself. No hard mode, no brochures, no brokers required.

Head to the Home Zone in-app to get an idea of how much you could borrow. Then when you’ve found the place you love, or are ready to refinance, it's easy to apply.

Turbo tools

When you join Up Home, your eligible Savers automatically flip into free 100% Offsets. Add Roundups and Payment Splits to your Savers to pay off your loan faster. Up Home also comes with free redraw should you need it.

To see what our automated savings tools could save you in time and money over the term of your Up Home loan, try our Upgraded Rate Calculator.

Get your Upgraded RateThe Upside is clear

Applying is simple, straight from the app, so you can get on with booking the movers and picking a colour for that feature wall.

We don't charge most of the fees that bump up those tempting 'advertised rates' when you apply at some other banks.

It's just a straight Up good deal for everyone – even if you're buying with a 10% deposit.

A first-class experience

Winner of the 2026 Finder Awards for the best ‘First Home Buyers home loan’ and best ‘Variable Home Loan with Offset’.

How much does

a home cost?

The slider above gives you an idea of what your repayments might cost if you borrowed 80% of the property price at a variable and comparison rate of % p.a. over 30 years, and the gross income you’ll likely need. To dig through how this is worked out, give this explainer a read.

Is Up Home right for me?

Up Home loans are owner-occupier loans for Upsiders buying in a capital city or major regional centre. You can get one for a home you already own, or a home you’ve fallen in love with.

There's a bit more detail hereIf you’re getting ready to buy soon

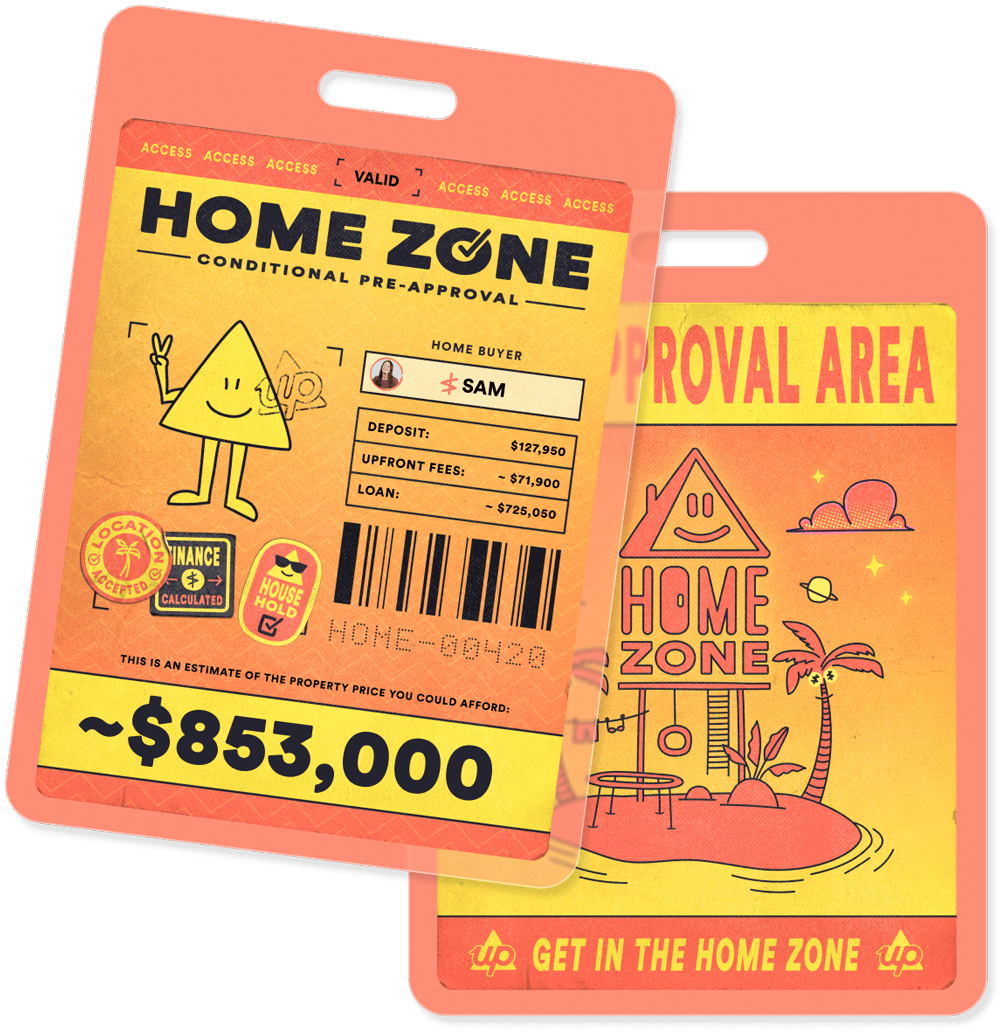

Enter the Home Zone.

The Home Zone is our superfast conditional pre-approval tool. It uses your Up spending insights to help you understand what you can afford to borrow. Better yet you won’t have to start from scratch during your search for a new home.

If there are a couple of properties you have your eye on, don’t stress, you can still get everything else assessed and confirm the exact property later using your saved application.

If you're ready to buy or refinancing now

We’ll guide you through everything you need to join Up Home.

To get started we'll value your property, check your details, run a credit check and validate your finances. If there’s something the Up robots can't find, our Welcome Home team will be in touch to help you out.

I'm ready to refinance

Great rates from day one

Our variable comparison and annual rates are the same, because we don’t charge most of the fees that can push comparison rates higher.

Current Annual & Comparison Rate

Tell us you’re dreaming

Not ready yet, but definitely keen to own someday? Why not kick off an Up Home Deposit Saver?

Home Deposit Savers are a special kind of Up Saver that shows you your total savings (including stuff you don’t keep in Up), minus costs like stamp duty. Get a timeline based on your real saving patterns. So you’ll always know where you are, and when you’ll likely be ready to buy.

Plus you’ll learn more about home buying as you save. So when you’re ready? You’ll be really really ready.

Up Home Learning Centre

Buying a home is one of the biggest learning curves life can throw at you. Let's get you sorted out with how to prep your finances, get some sweet subsidies, and master home buying buzzwords.

Ready to apply?

The keys to Up Home are in your app. Scan below for application gratification. If you're not an Upsider yet, you'll need to join first. If you're keen for a chat over the phone, you can reach out to our Up Home Guides during business hours (9am-5pm AEST/AEDT) Monday to Friday. Just dial 1300 002 258 and select option 3.

The Finer Details

Home loan words can be… a lot. Check out our plain English guide if anything on this page could use a little explanation.