Saver Offsets and Free Redraw

Offset accounts: they’re your secret weapon for owning your own home faster. And with Up Home you don’t even have to think about them to get all the good stuff.

If you get a 2Up loan, all your 2Up accounts (both Spending and Savers), as well as your personal Up Spending account, become free offsets: you won’t have to change a thing. If you take out a loan on your own, your individual accounts are all free offsets. Easy.

But what is an offset?

In your everyday life, offsets work just like a regular spending account or Saver. The money in them is yours to use. But before we calculate how much interest you owe on your home loan every month, we subtract the total amount you're keeping in them from your current loan balance.

Say you're paying down a loan of $400k, and you also have a holiday Saver that's grown to $5k, and about $1k that you keep around for groceries and stuff. When your interest is calculated, you'll pay interest on only $394k. It's all calculated daily so it's not exactly that simple — but we reckon you get the idea.

You’ll probably make the same repayment you always did, but a bit more $$ goes towards owning your home, and a bit less to us. Which we are all about, cause the goal here is to get you from Up Home, to your home.

Old school loans usually come with one or two offset accounts, or a redraw facility. You’ll probably pay a monthly fee for the privilege, and they’ll be separate from your regular banking. We feel like just taking the Savers you’ve already set up the way you like them, and making them do a bit more work, makes a bunch more sense for you.

But wait, what’s a redraw facility?

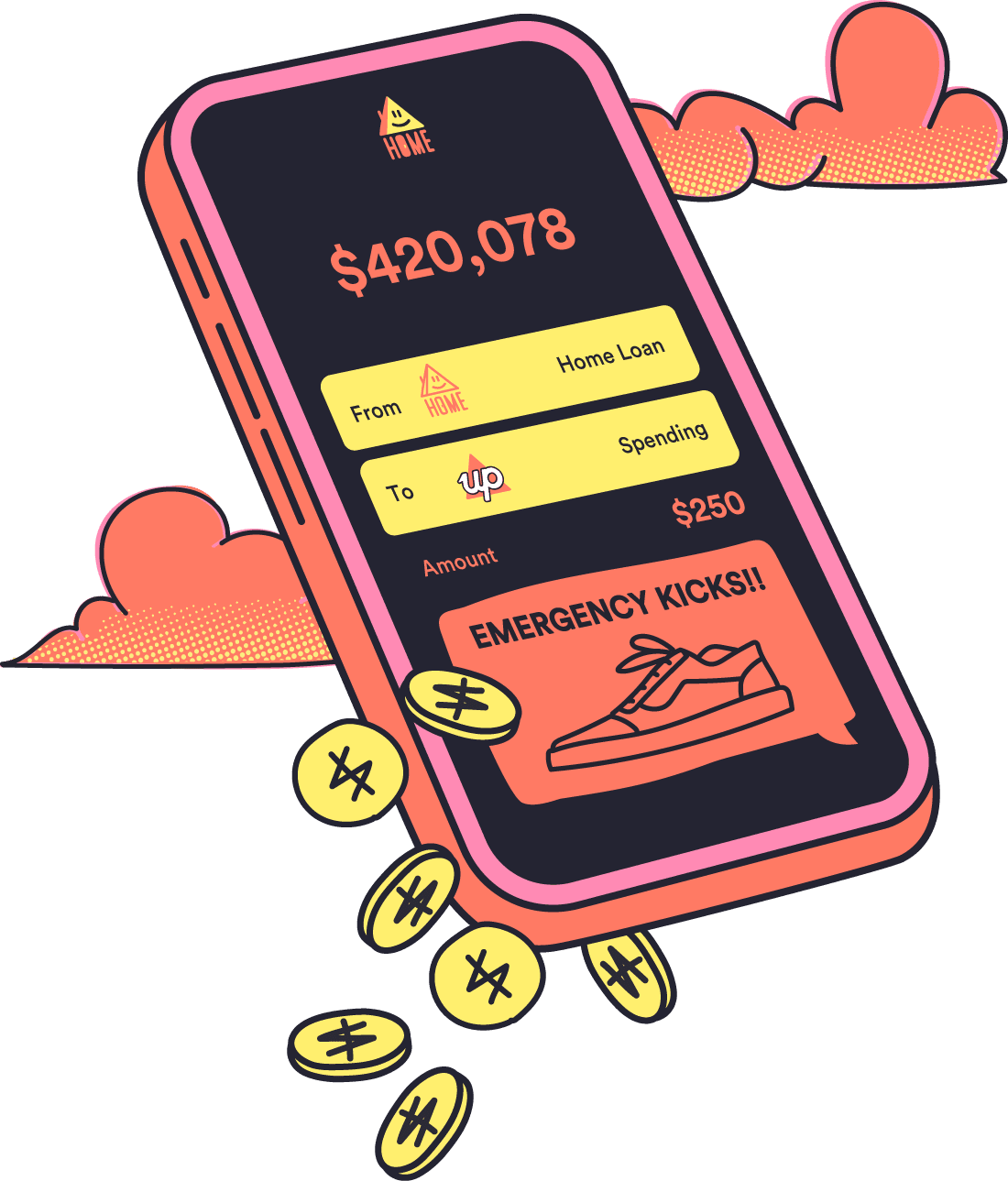

Redraw is another way you can save on interest. You can make extra payments on your loan if you want, pay less interest as a result, and later change your mind and have some of the extra money back.

Redraw is free with Up Home too.

So if paying more on your loan would feel good to you you can put it directly into your loan account. Or if you prefer to keep your money organised with Savers, Saver offsets might be more your style. Or mix them up! It’s up to you, cause every day your money is in one of these accounts reduces the interest you pay on your loan.

Go thrive.

(P.S. though — you won’t also earn bonus interest on Savers like you did when they were regular savings accounts. We’re magic but not that magic).

The Finer Details

Home loan words can be… a lot. Check out our plain English guide if anything on this page could use a little explanation.