Up turns 2! But we're turning up for you.

Geez, blink and you'll miss it. It's Up’s 2nd Birthday!

We might be cutting the cake on twenty four months, but the end game is still as clear as it was the day we launched. We’re here to help - by giving you tools to understand your spending, and build rock solid savings habits.

We've seen a lot of love in our short time on this planet. Media attention, awards and corporate pats on the back are ace, but the real deal for us is you.

We’re feeling good when you’re feeling good. And when you’re kicking goals, we’re kicking them too.

So rather than putting together an emotional powerpoint preso and giving an absurdly long speech, let’s take a look into what you and all the other Upsiders have been Up to (get it 😏). We’re powering Up (sorry) the ol’ data machine, and reminiscing over all the incredible feedback we’ve seen over our first 2 years.

Even that one time we got a one star review because we ‘don’t look like a real bank.’

Here’s 10 ways we’ve seen you taking back control of your money with Australia’s first mobile-only, digital bank (that’s actually a real bank. Promise).

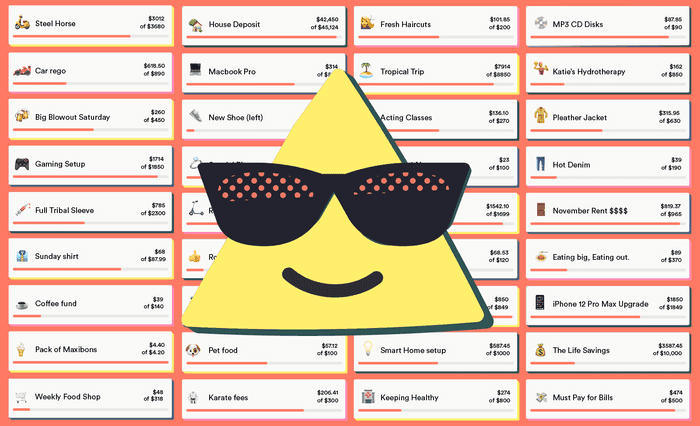

1. You’ve become savings superstars.

From day one, we were sure you’d want heaps of stress-free ways to stash your cash. Everyone needs to know if there’s enough for the bills and a 5-star Sunday morning brunch, right?

So we shipped multiple free Savers complete with names, business-critical emoji integration and dollar goals to keep you working on your Savings plan. You took them and you ran.

Upsiders currently have an overwhelming 550,000+ Savers, and you've customised more than 80% of them.

Build those goals up, tear them down. Aim for the stars, land in the clouds.

I am legit spinning around on my chair being like I wonder what else I can save for

2. You’re the sheriff in town, and you love to Round Up.

Round Ups are a part of who you are now. Every time you spend, you’re also keeping your Savers fed.

Most Upsiders have Round Ups turned on, to fling a few extra cents from every purchase into a Saver. Sounds like a little? It’s a lot. In 2 years you’ve put away a VERY solid $10 million in standard Round Ups. Some Upsiders don’t even realise they’re saving - others have a special account for Round Ups that funds ‘free’ treats on the reg 🍟

That's over 20 million Round Ups and my, haven't you done well!

The round-ups and automatic savings transfers are making me save money without even realising it.

3. You make life easy by playing on Hard Mode.

Your Round Ups roundup doesn't stop there. You liked Round Ups so much we upped stakes with Boosted Round Ups, the ability to bump every Round Up by as much as an extra $10 a pop 😮

43,000 of you have supercharged your Round Ups with a boost, so that even dollar purchases cop a Round Up too. 28,000 take it even further by boosting your Round Up amount from $2 and up - and 3,300 of you actually use that $10 max 😲

We bow to your budgeting superpowers ⚡️

That adds up to a grand total of more than $24 million in all types of Round Ups. Enough to buy every Upsider not one, but two copies of the Lord of the Rings theatrical release box set on DVD, and a medium Whopper meal to go with.

4. When you Pull, you Pull often. Pull-to-Save that is.

Last year we snuck in a super-sneaky savings feature called Pull-to-Save. Give your Up activity screen a mighty downwards pull to send your excess cents flying sky-high and straight into your Round Up Saver. Once you noticed (and it did not take long for you to notice), you were all about it. Pulling in the line at the cafe. Pulling in bars. Seriously, you’re quite the artists and we stand in awe.

Since launching, Upsiders have pulled and saved 1.2 million times, saving more than $900k.

Nice pull.

I no longer get anxiety... It’s even fun to use, like the pull down to quickly chuck a dollar or the cents left over, into your savings… That little bit of detail alone really does a huge amount.

5. Ditch the floaties: you’re lapping Saver Pools like a pro.

It's hard to get invested in just a number on a screen.

This year Upsiders chucked on their boardies for an interactive visualisation - all of your saved cash in its fresh, saltwater Saver Pools. You didn’t dip, you dove into your Saver Pools, watching them drain or fill in real time as money moved in and out, and changing your budget for more Saver funtimes.

Upsiders decided that shaking up their phones and sending Saver coins flying ‘round the screen was as satisfying as furiously shaking a bag of $2 coins (highly recommend giving it a try). You’ve been crafting even more unique Saver goals and tracking their progress more closely as your Pools fill to the brim.

Before I go to sleep at night I open my Up bank app to look lovingly at my money in their savers with their cute emojis and when I turn the phone from side to side all the champagne bubbles bounce around to celebrate! Thank you!

6. You’re hungry for more Spending Insights.

Insights on your money moves? You can’t get enough - no matter how much we add, you ask for more. (We’re not even mad, that’s amazing).

Right now you’ve got daily and monthly spending data at your fingertips. Each purchase you make is automagically categorised into four high-level spending categories so you can easily see when it’s time to ease up on the ‘Good Life’ and maybe spend some more money on ‘Home’. Or, you know, the other way ‘round. Life is a journey.

From there you go granular. Time to cut down on indoor plants, or limit your HSP runs to once a week? You’re all about using Insights to bank more great habits.

Your Insights are yours and yours alone to help you get on top of your spending - but it would be rude not to share where the biggest chunks of aggregated spending have gone over the last 2 years.

- GOOD LIFE: 33.1%

- PERSONAL: 25.7%

- HOME: 29.3%

- TRANSPORT: 11.9%

FUN FACTS:

- Your favourite midnight snack is a sneaky Maccas run

- Upsiders narrowly prefer Woolies to Coles

- Home sweet home: 50,000 Upsiders have made Bunnings runs 🌭

- Your favourite 🍩 comes from Donut King, where just over 25,000 purchases have been made over two years: Krispy Kreme trails at 16,000

You’ve even helped us build a database of over 150,000 identified merchants - many with logos for at-a-glance Insights - so your fellow Upsiders can have all the Insights they can eat, too.

This is a budgeting app that just so happens to be a bank.

7. You blast Upcoming bills at an A-grade level.

Speaking of Insights, you’re really, really into Upcoming bill prediction. Up learns about your regular charges, and predicts when they'll be charged next so you know how much you really have to spend in the weeks ahead. We didn’t predict (😛) how into it you’d be.

Is there any better feeling than having all the money you need, ready to go? Bill-stress-b-gone: over 50,000 Upsiders use Upcoming to turn their budgeting volume up to 11.

That’s a lot of Netflix, and car regos, and mobile phone contracts, and insurance, and electricity bills, and Afterpay installments. Sorted.

If you’re not yet in that 50,000, maybe this is your day to see all the way to the horizon.

I recently got all my renewal notices for my car insurance, rego, etc., and for once I wasn’t scrambling for money. My Saver is now at 0% but there’s a little bit of fulfilment in that zero 😊

8. You’re a great mate.

Consider yourself the grape vine, ‘cause everyone is hearing it through you.

Very soon after launching, we realised Upsiders were keen as mustard to get some of their friends in on the action.

So while some of you were totally cool to suit up and pitch a 2 hour preso to your pals, we made it simpler so you could just shoot out a quick referral text and then both of you would score some cash. Heaps easier.

One of our proudest feels is that people think Up is worth sharing: almost half of all Upsiders found us through a mate, and stuck around.

Onya champ, you’re a good mate.

I am constantly attempting to convert friends. I show them the interface, explain round-ups, show them the structure of accounts and the chat… (they) end up making the switch. It's also a win for me because it makes transferring money between friends so much easier. Win.

9. And now our mates are your mates!

Our hobby: building sweet collabs, learning from the best, and building solutions that actually work. We went looking for the yin to our yang. The you to our us - but for business.

We started out in mateship: nifty Melbourne tech company Ferocia, plus community focused Bendigo and Adelaide Bank. On our journey we’ve buddied up with Mastercard® for priceless payments; Google for fast, secure hosting; AfterPay so you can see and manage all your costs in one place; and TransferWise to move money wherever it needs to go in this wide and crazy world.

You love them too, which makes us happy because when everyone’s mates you never have those awkward parties where everyone just stands around in little circles.

4,000 of you, for example, have already sent international payments around the globe almost instantly using TransferWise within Up, with the fastest dough landing in Japan in less than 50 seconds (on average). So far the top places to give your AUD a new life overseas have been Nepal, India, New Zealand, England and the USA.

It used to take me 3 minutes to use TransferWise before, but now it takes me less than 30 seconds. Up x TransferWise is one of the few good things that happened this 2020. Kudos!

10. You’re always up for a chat, and your banter is spot on.

When we started, 'Support' was Dom, our co-founder churning through queries - one hand on the keyboard and the other tweeting directly with Upsiders. He's an absolute machine, but even the best need a break.

We pretty quickly realised Australia’s first mobile-only digital bank needed a support network that felt real, just like you were messaging a mate for help.

Traditional support software solutions were too tight and constricting so we set out to build the cargo shorts of Support systems. Comfortable, stylish and practical for all activities, all year round.

What we ended up with was a system where our team could be our pure, uncensored selves and could have quick banter with all Upsiders without breaking a sweat. And we can tell you right now, you’re bringing it every day.

Dad jokes, multi-day meme streaks, tales from a massive weekend...Even you messaging to check in on US 😭 We see it all and we're 100% here for it. If you haven't fired up Talk to Us for a question or if you need help with anything at all. Maybe it's time to give it a go. Who knows, you might just find a friend.

I never knew a bank could feel so human?

To the Upside, and Beyond.

Still learning how to fly it properly

(So are we Neri. We’re glad to be learning with you.)

Those of us who work on Up are engineers, designers, and dreamers. And every day we come in to see how we can do more. To fundamentally change a broken system where banks get rewarded for keeping people in the dark.

Two laps around the sun, more than 280,000 🤯 incredible new mates, and over 50,000 savings goals smashed, we’re so proud of all we’ve learned from you, and all the things you’ve achieved.

So what’s next? Let’s find out together.

With 🧡 from the whole Up team.

Tags: History, Upperversary, Pull to Save, Hook up a Mate, Insights, Upcoming, Bills

Get the gist

We’ll swing our monthly newsletter and release notes your way.