Afterpaying with Up

Feb 04, 2019 · How to Up, Spending and Budgeting

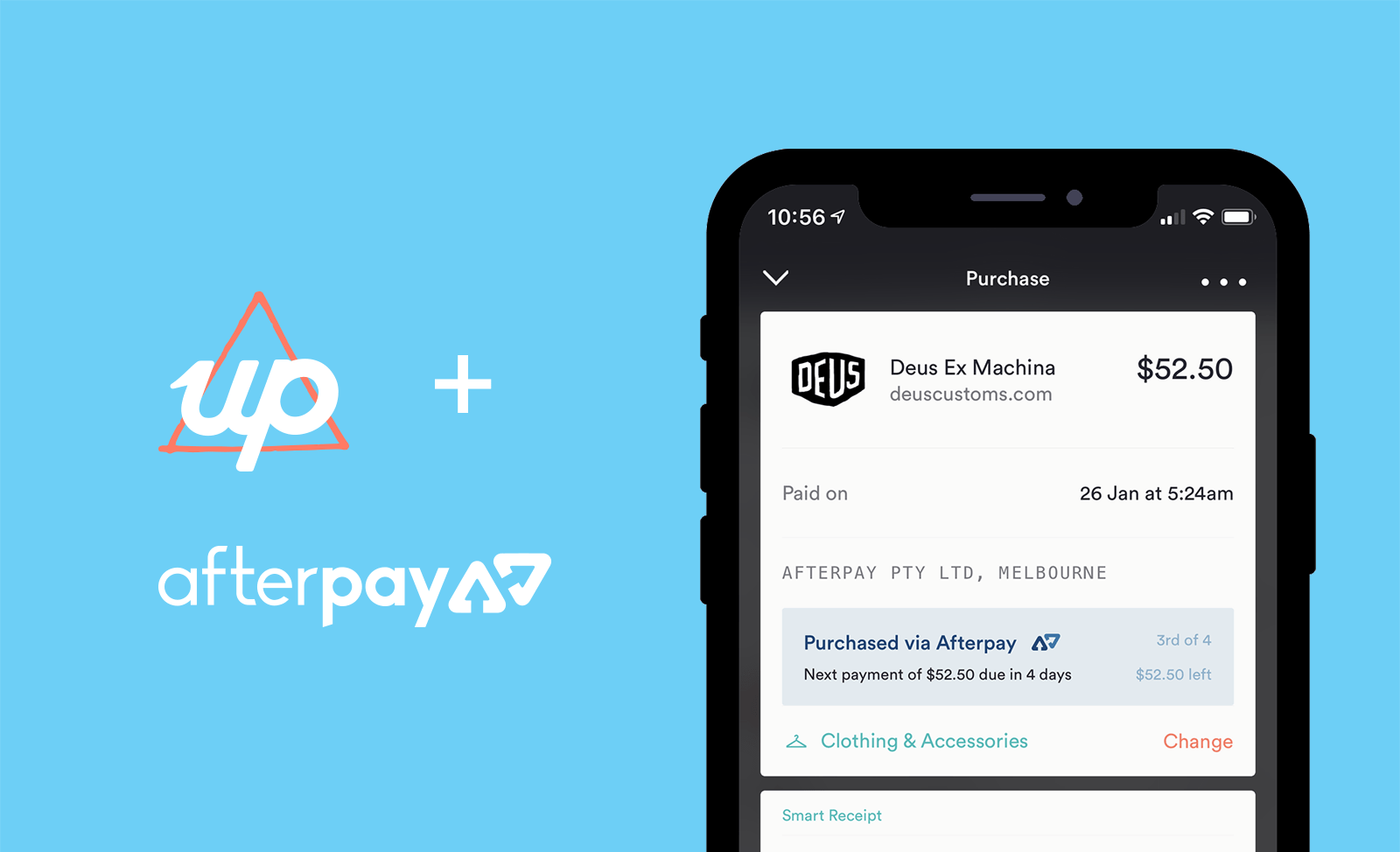

Spending wisely requires being more connected to your past purchases than many of us are today. It also requires a better understanding of your future spending commitments. Armed with knowledge of the past and future you are able to make better informed — wiser — spending decisions. Today we’re pleased to announce an important step along that journey. With today’s release, Up has become the best way to Afterpay.

Millions of Australians have embraced Afterpay as a way to pay for everything from clothing and sporting goods through to car maintenance and dental work. While Afterpay has its critics, their customers truly love the service. Fan groups across Facebook, for example, attract hundreds of thousands of supporters.

While Afterpay currently provides information to customers through SMS notifications and in the Afterpay app, we felt there was a role to play for Up in helping our customers better understand their Afterpay activity — both in terms of their past spend as well as their upcoming commitments.

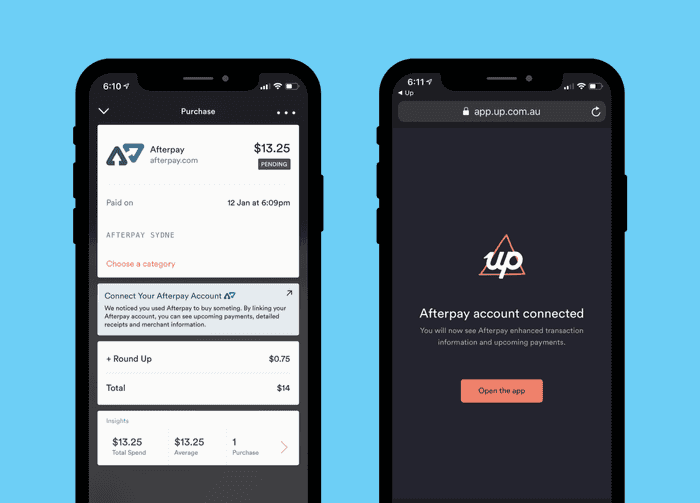

Up now lets you simply and securely connect to your Afterpay account. Doing so unlocks some amazing enhancements. But first, let’s get connected.

Getting Started

To get started, simply find any Afterpay transaction in your Up activity feed (you must have at least one to begin) and tap it. On the receipt you’ll see a panel prompting you to connect to Afterpay. Follow the instructions to complete setup.

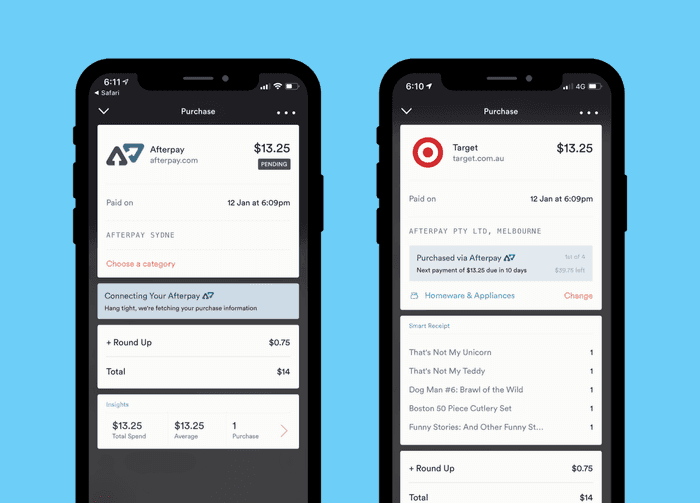

Smart Receipts

Instead of simply just showing Afterpay as the merchant (they do the charging on behalf of their merchants) we can now show the name, logo and category of the business you made the purchase at. Up shows you where you are up to in your four payments and the amount remaining to pay. In most cases Up will even list the items you purchased.

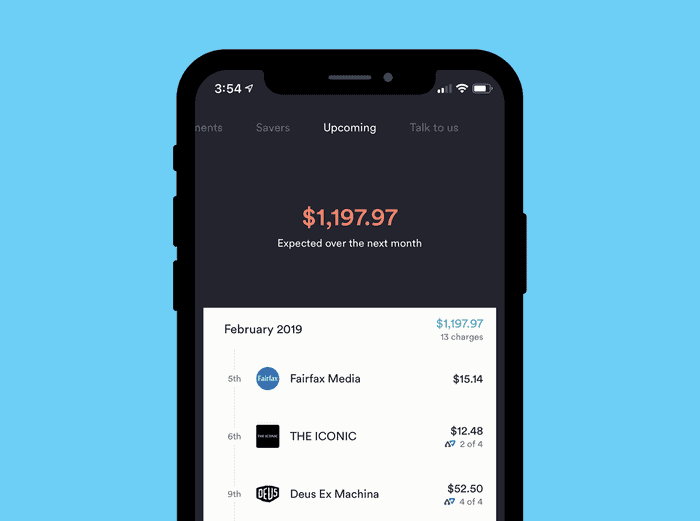

Upcoming

Our Upcoming screen now includes your future Afterpay instalments alongside your regulars. And you get the same great features — a heads-up a couple of days before payment is due and a special note if you need to top up your balance to cover the charge. You can now see a 30 day total that includes both your regulars as well as Afterpay charges.

We think using Afterpay through Up enables a new level of responsible spending. It is a glimpse into where we see the Up activity feed progressing — into a place that provides great visibility and understanding around your money and leads to better informed decisions.

We’re keen to hear what you think of our solution.

Tags: Afterpay, Smart receipts

Get the gist

We’ll swing our monthly newsletter and release notes your way.

Designing a Super Powered Welcome Experience

For a branchless digital bank, the tangible moments you have with your customers are few and far between. We relished the opportunity to design both our debit card and its welcome pack from scratch.

Daniel Wearne

Top 10 highlights from 2018

Happy New Year! While 2019 has just begun and there are so many awesome things planned for Up this year, I just thought it’d be cool to look back at a few highlights from 2018.

Dom Pym